Tobacco control is clearly helping to save millions of lives but the scale of the epidemic demands our continued attention and support. Though consumption is declining, smokers are still buying trillions of cigarettes each year and the use of newer tobacco products is increasing in some countries.

We are back with this 7th edition with new data, analyses and developments. We present the key tobacco-related challenges that the world faces and the solutions that are working to help beat the epidemic.

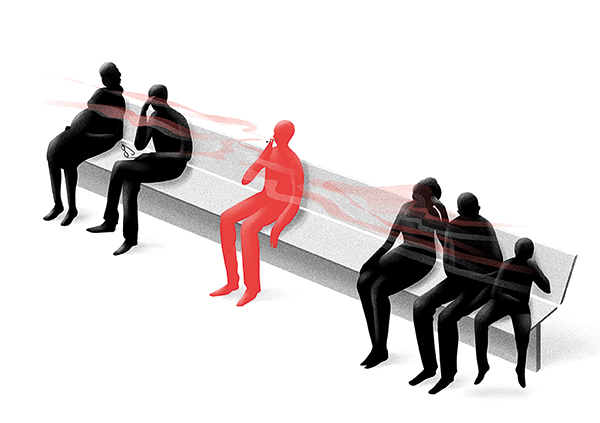

Read more about Prevalence

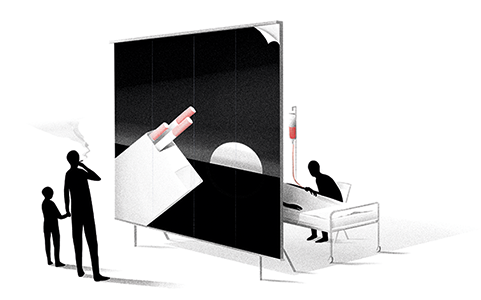

Read more about Cessation

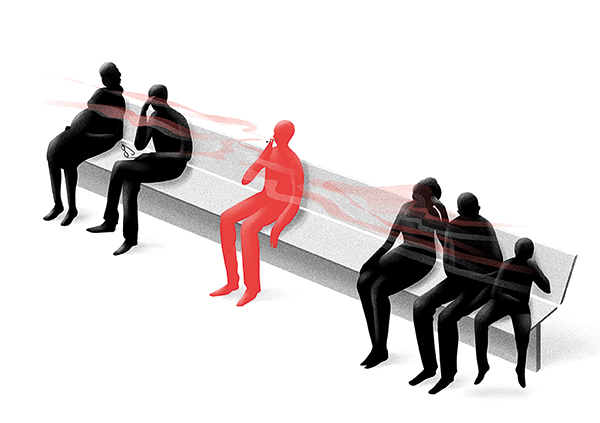

Read more about Health Effects

Read more about Product Sales

Does your country have strong policies in place? Browse our country factsheets.Tobacco taxes are the most effective tobacco control intervention but the least implemented. A sufficiently large tax increase will raise tobacco product prices—making them less affordable—thereby discouraging initiation, encouraging quitting, and driving down consumption. Read about Taxes

The 2nd edition of the Tobacconomics Cigarette Tax Scorecard measures cigarette tax policy performance in 160 countries in four key areas – price, affordability change, tax structure and tax share. These scores help policymakers to evaluate their success and provide a roadmap for improvement. Visit Tobacconomics Cigarette Tax Scorecard